How much does a house cost in Ottawa | 2021

Even though we no longer live in Canada, I get asked quite often how much it costs to buy a house in Canada, or more specifically, in Ottawa. So this post is, hopefully, help figure that out, now in 2021.

For those who are new around here, we lived in the Ottawa – Ontario region for 12 years before we moved to Germany, where we currently live in August 2019.

There’s a post about how much it costs to buy a house in Canada that I wrote in 2015 and it still brings many of you here on the blog, because it really is a complex issue.

Nós vendemos nossa casa no Canadá antes de mudarmos e ainda estou devendo este post aqui no blog!

I always follow the real estate market in Ottawa and looking at the recent numbers now for 2021, it’s obvious that the house hunting is super hot, mainly due to a shortage of properties compared to demand.

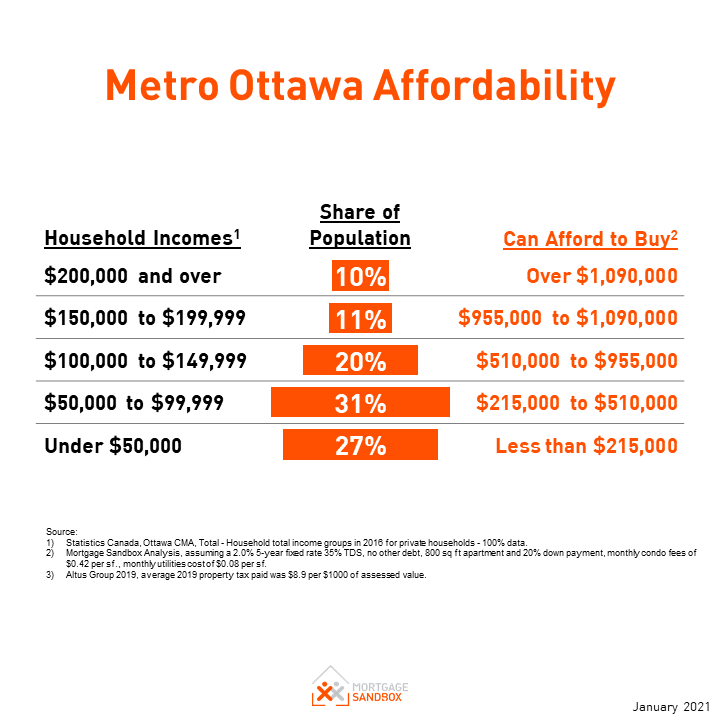

According to data from the Ottawa Real Estate Board (OREB) from early 2021, the average value of a home in Ottawa in 2021 is around $717,000 Canadian dollars, up 27% compared to the same period in 2020.

So it’s obvious to assume, the competition is fierce! Usually the most targeted properties are 3-bedroom homes. When such houses come on the market, they take only 12 days on average to sell, often with multiple buyers and offers.

Meanwhile, for those with their eye on condos (basically what the apartments are called), the average value is CAN $407,000.

And for those who are thinking of buying a house in Ottawa this year, I have made a simulation of financing (with data compiled from the internet), what we call a mortgage. The vast majority of Canadians and immigrants buy their homes through financing.

To obtain a mortgage, the government requires a down payment of 20% of the house value, which for a $700,000 Canadian dollar house, the down payment is $140,000.

Many people obviously don’t have $140,000 in their bank account to make a down payment, and in cases like this, it is possible to make a minimum 10% down payment ($70,000), but then it is mandatory to get mortgage insurance and pass a stress test of your finances (simulating whether your finances will remain sound if rates rise in the near future).

This ‘mortgage insurance‘ is obviously not free! In the case of a 10% down payment (minimum required for houses over $500,000) on a $700,000 house, the insurance will cost around $28,000 (considering the interest rate of 4%/year), incorporated into the mortgage, which makes the total post-entry financing C$679,000.

So that is why many buyers today try their best to collect the 20% to avoid this scenario (the 20% cannot be obtained through a loan, as it increases the buyer’s debt).

Among numerous factors that can vary in obtaining a mortgage in Canada, it is currently mandatory that the monthly amount does not exceed 35% of the household’s monthly gross income (including utilities – that is the monthly costs for water, electricity, gas, garbage, internet, etc.) or 42% of all debts/debts of the buyer (including car financing, loans, etc.).

The monthly mortgage will be around $1,575, paid every 2 weeks (bi-weekly) for a house of $700K. You have to add into this amount the monthly costs for utilities, property taxes and home insurance, which depend on the location, age and condition of the house or condo that you are buying.

In summary, there are many things to consider, but as a first step, it’s important to open a bank account in your city and on top of that, if possible, get a credit card (even with a low limit at first) and keep the accounts up to date to build your credit history in Canada, which is extremely important to obtain a mortgage.

Good luck to you, future homeowners! I always used Realtor.ca to search for properties for sale in Ottawa (and Canada).